April 22, 2024

Atria Capital – Vietnam Update April 22nd 2024

Vietnam has had its share of billionaire celebrity visits in recent years but Apple CEO Tim Cook’s recent visit was probably one of the most meaningful in the light of recent global news coverage relating to Vietnam.

Apple began operating in Vietnam over a decade ago and is supporting over 200,000 jobs across the country in areas such as supply chain and the iOS app economy. More recently, like many other manufacturers such as Samsung who has long had a presence in Northern and Southern Vietnam, Apple has been looking at reducing its reliance on China for its assembly with Vietnam and India emerging as key strategic alternatives, with Covid-19 only accelerating that trend. Today, Vietnam is involved in the development and manufacturing of the MacBook, iPad and Apple Watch and Cook announced plans to boost spending in Vietnam beyond the $16 billion it said it has spent since 2019 through supply chains in Vietnam with its suppliers such as Luxshare, Foxconn, Compal and GoerTek operating factories employing over 200,000 local workers. In contrast to recent somewhat negative or sensational international news coverage about Vietnam, sophisticated and longer-term investors such as Apple are intensifying their focus on Vietnam and the opportunities it offers.

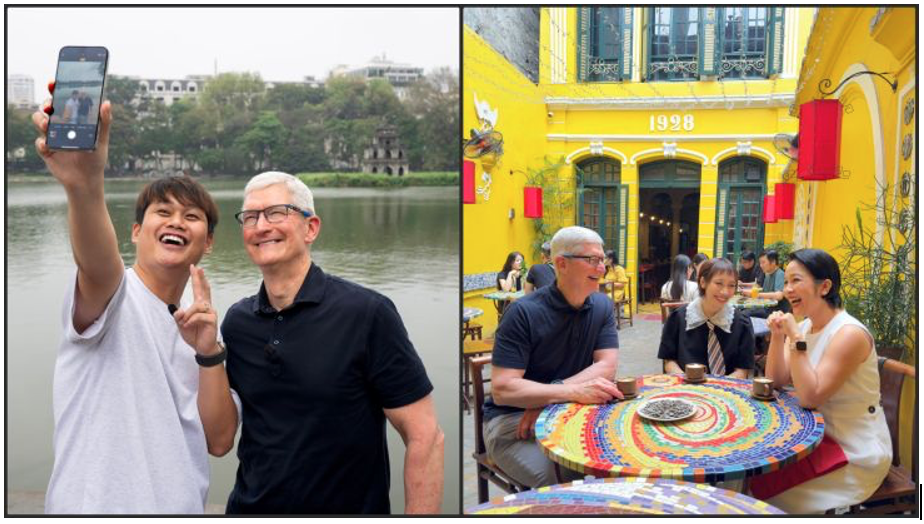

Tim Cook in Hanoi on April 15th 2024 taking a selfie on Hoan Kiem lake with a v-blogger and content creator Ngo Ngoc Duy and having an egg coffee with My Linh and My Anh, two singers/entertainers in a local cafe

Vietnam is booming and its economy is doing well despite some road bumps along the way which is to be expected as a fast-developing economy and emerging market. The fundamental long-term story is intact, if anything even stronger than pre-Covid-19, with the impact of the China+1 strategy of many manufacturers and Chinese manufacturers themselves establishing operation in Vietnam as a future hedge on labor costs and skills availability, as well as the geopolitical and trade tariffs risks. The US has strengthened its relationship with Vietnam amid growing tensions between Washington and Beijing with President Biden announcing during a historic 2023 state visit an elevated “comprehensive strategic partnership” with Vietnam. Additionally, the EU Free Trade Agreement ratified in 2020 was a cornerstone commercial agreement aimed at removing 99% of all tariffs and deepens the Vietnam-EU relations beyond any historical comparison.

Vietnam is going through a once in a generation creation of one of the largest middle classes in the world within a short period of just a decade. From the current 10-15 million people part of the middle class, McKinsey estimates that half of the Vietnamese population (or about 50 million people) will enter the global middle class by 2035. This exponential growth is fueling consumption and GDP growth and also explains that Vietnamese consumers’ optimism remains one of the highest amongst countries globally. Despite the combined headwinds of higher interest rates, a momentary drop in manufacturing orders from the West and a very aggressive anti-corruption campaign throughout 2023, creating a so-called “perfect storm”, the resilience and adaptability of local consumers and the domestic economy has been like no other.

All of this brings perspective to the recent global news about the country’s biggest financial fraud case amounting to $12.5 billion or 3% of the country’s GDP for which one of the most prominent domestic real estate tycoons was recently sentenced to death. What the case of Madam Truong My Lan highlights (Van Thinh Phat or VTP and Saigon Commercial Bank or SCB) is the intensifying anti-corruption drive that started at the end of 2022 in Vietnam and has so far claimed several other real estate and business tycoons including the country’s largest soft drink manufacturer. Additionally, anti-corruption measures occurred in the political arena, whereby there was a crackdown on politicians including two Presidents forced to resign (within slightly more than a year), two Deputy Prime Ministers also resigning (in January 2023), as well as ministers, provincial leaders and numerous other government and central bank officials either resigning, fined or jailed relating to various corruption cases and scandals. The recent drive by Party General Secretary Nguyen Phu Trong (the top ranked official in the country) to crack down on graft in the so-called Blazing Furnace campaign has been far reaching seemingly leaving no stone unturned and no one immune regardless of wealth, power or fame sending a strong message that no one is untouchable. Whilst this has created temporary government paralysis and shocked the business circles in Vietnam initially, the long-term benefits of rooting out such rampant practices in banks and business circles and governmental bodies are obvious for the country and with over 4,400 people indicted to date across 1,700 graft cases since 2021, this campaign is ultimately position for Vietnam and demonstrates the Government’s commitment to tackling these issues and restoring confidence among citizens and foreign investors alike.

It is important to note here that Vietnam has a long history and tradition of collegial decision making and governance and that despite the perceived political instability internal infighting seems to create, the main longer-term policy and development goals remain intact and rely much less on individual personalities and politicians than on established policies and constituencies. The Government has consistently pursued pro-business, investor-friendly policies over the last two decades irrespective of who was in the top positions and we have every reason to believe that this will remain the case. Therefore, the development goals remain unaffected over the long run by such political turmoil and we do not expect any significant policy shift whilst factional skirmishes could remain a temporary factor until a clear succession for the current Party General Secretary is announced, especially ahead of the next major elections in 2025 and new Congress in early 2026. In the meantime, investors and all stakeholders will have to live with the country’s new political reality.

In summary, our view is that the Vietnam economic growth story remains compelling despite the current market disruption and if anything, is seeing a rapid acceleration post Covid-19 with recent macro-economic indicators all flashing dark green (FDI investment, GDP growth – 6.72% YoY in 4Q23, industrial output, etc.). The tourism industry has also been rebounding very strongly although has not returned to pre-Covid-19 levels but is bringing much needed foreign currencies and growth back in a sector devastated by the pandemic. Total FDI commitments are up about 13.4% YoY as of Q1 2024 mostly from newly registered projects primarily in manufacturing and real estate. UOB just reiterated their 6% GDP growth forecast for 2024 with the ADB expecting 6-6.5% thereby matching the official target set by the Government. Supporting this growth, the State Bank of Vietnam aims to boost loan growth to about 15% in 2024.

On the back of this, we fully expect consumer sentiment to rapidly return to outright optimism and fuel continued strong growth in consumer-led sectors and mass market residential real estate. The last 18 months have only accentuated the large gap between demand and supply, the latter not even close to keeping up with the increase in demand for good modern affordable housing of the booming middle class. Recent events have put out of business many local real estate developers whose business model was based on access to cheap and loose credit, government attributed land banks and corrupt practices. If anything, the recent events have brought a level playing field for the market and benefits companies with strong governance and access to reliable longer-term capital. This situation has also not only put a stop to the excess land speculation that reached a peak in 2022 but also significantly rebased land owners’ expectations in terms of values and deal structures, thereby creating a unique window of opportunity for new investments in quality projects targeting the residential needs of this middle class at land purchase values unseen in 10 years.

Vietnam is the tale of two or maybe many stories and it takes local knowledge to decipher international news coverage about the country. We hope this write-up has been helpful in shedding some light on recent events and international news, we believe we are on the tail of this temporary crisis although remain convinced more scandals or resignations are in the works. The VTP case is most likely the opportunity to draw a line in the sand which could be one of the reasons of the severity of the sentence of Madame Lan and the unprecedented bailout effort undertaken by the government. This should also be the time to remind ourselves that the current generation of Vietnamese (with two thirds born late 80s onwards), has only known improving lifestyles and lives since their youth and are not encumbered by any of the difficult history the country has gone through since the colonial era. Much like those people, the new generation of government officials have also seen significant benefits from the last two decades of compound annual economic growth. There is no doubt in anyone’s mind about the benefit of private property and market openness but similarly to other previous examples of rapid development, road bumps are to be expected and for the smart and discerning investors able to stomach some noise and bumps in the road, these are creating unique value opportunities to capture the long-term growth story and once in a lifetime transition to market economy Vietnam currently offers. By the time the dust settles and perceived political stability undoubtedly resumes, those opportunities might have passed as history has shown rapid rebounds and catch ups post crisis, unsurprisingly given the compelling story offered by the nation of 100 million people.

Share